In the world of investing, knowledge is more than power—it’s protection, precision, and potential rolled into one. Before you commit a single euro, it’s essential to understand the landscape you’re stepping into. From assessing risk to verifying a company’s credibility, the decisions you make early on can significantly influence your long-term success. That’s why we’ve put together the 10 things every investor should know first—practical, experience-backed insights to sharpen your strategy and build confidence from day one.

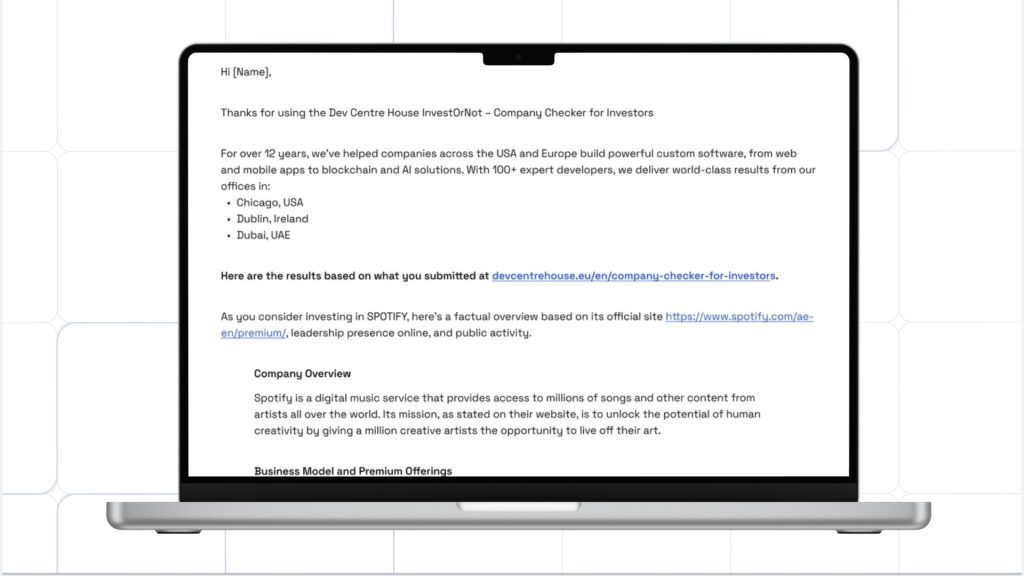

Today’s investor operates in an environment that’s more accessible, yet more complex than ever before. With tools like InvestOrNot, powered by Dev Centre House Ireland, the barriers to accurate, in-depth company checks are being torn down. But while tools are important, the real edge lies in knowing how and when to use them—and why certain principles matter more than others.

Let’s dive into the essentials that every smart investor should know before taking the plunge.

1. Understand the Difference Between Investing and Speculating

It may seem like semantics, but this distinction is crucial. Investing involves calculated risk based on thorough research and long-term value. Speculating, on the other hand, leans on short-term gains and gut feeling. Knowing which one you’re engaging in sets the tone for how you evaluate opportunities—and how you use platforms like InvestOrNot to guide those decisions.

2. Company Research Isn’t Optional—It’s Fundamental

Every investor should know first that no amount of hype replaces hard data. Whether you’re exploring a tech startup or a manufacturing business, you need clear insight into its background, leadership, financials, and history.

This is where Dev Centre House Ireland makes a difference with its platform, InvestOrNot. It gives you streamlined access to company information across Europe—helping you avoid the guesswork and uncover the reality behind the pitch.

3. Due Diligence Is More Than a Checklist

A common mistake among new investors is treating due diligence like a formality. In reality, it’s an ongoing process that evolves with your portfolio and your level of exposure. Beyond checking basic credentials, you need to look at patterns—such as director changes, legal disputes, and shifts in revenue streams.

Using a tool like InvestOrNot ensures you’re not relying on outdated or scattered data but rather making choices based on verified, up-to-date information.

4. Not All Risks Are Created Equal

Every investment carries some level of risk, but not all risks are visible on the surface. Market volatility, poor governance, legal uncertainty—these are often buried beneath layers of financial jargon. One of the most empowering things an investor can do early on is learn how to identify these red flags.

By analysing multiple data points through platforms like InvestOrNot, you can develop a sharper eye for the kind of risks that matter—and the ones you can afford to take.

5. Geographic Location Matters More Than You Think

In a globalised market, investing beyond your borders is easier than ever. But with that comes the need to understand regional laws, economic climates, and regulatory systems. For example, investing in a company registered in Eastern Europe might offer high growth potential, but it also comes with governance challenges that differ from Western European norms.

This is another area where Dev Centre House Ireland’s company checker tool stands out. It removes the geographic friction by giving investors access to reliable information across jurisdictions, all in one place.

6. Emotions and Investing Rarely Mix Well

Every investor should know first that emotional decisions are rarely profitable ones. Fear, greed, impatience—these forces can cloud judgement, especially during market highs and lows. Confidence doesn’t come from enthusiasm; it comes from clarity.

With access to factual company reports via InvestOrNot, you create space for logic to lead your process, and emotions take a back seat where they belong.

7. Diversification Is More Than a Buzzword

Spreading your investments across different sectors, regions, and risk profiles is a strategy that works—because it’s rooted in the simple truth that no one can predict the future. But diversification only works if you understand what you’re investing in.

Blindly picking a “mix” of companies without digging into their operations and stability is no better than putting it all in one place. Thanks to InvestOrNot, you can diversify with intention, backed by credible insight.

Check Insights at https://www.devcentrehouse.eu/en/company-checker-for-investors

8. Past Performance Is Not a Guarantee, But It’s Still Valuable

While no company’s past results can promise future success, trends in revenue, profit margins, or legal stability can tell you a lot. Before jumping in, review how a company has evolved, especially during economic downturns.

InvestOrNot lets you track these shifts with detailed business histories, helping you understand whether a company can adapt—or whether it’s prone to crumble under pressure.

9. Stay Updated, Always

The investment world doesn’t sleep, and neither should your knowledge. Markets shift, regulations change, and companies pivot. That’s why every investor should adopt a mindset of continual learning.

Dev Centre House Ireland built InvestOrNot with this very need in mind. The platform isn’t just a snapshot in time—it’s a real-time tool that evolves with the companies it monitors. This ensures your decisions are informed by current realities, not outdated assumptions.

10. Reputation and Transparency Still Count

In the age of flashy branding and social media storytelling, it’s easy to get swept up in a compelling narrative. But behind every great story, there needs to be substance. Transparency, accountability, and good governance remain core pillars of any solid investment opportunity.

With InvestOrNot, you can see past the marketing and into the actual structure of a company—ownership details, director records, financial transparency—all of which speak volumes about who you’re trusting with your money.

Conclusion: Build Confidence Before You Invest

The truth is, investing is never risk-free—but it should never feel like a shot in the dark. By knowing the 10 things every investor should know first, and using the right tools to support those insights, you transform from a hopeful participant into a strategic player.

InvestOrNot, developed by Dev Centre House Ireland, isn’t just another fintech tool—it’s your gateway to clarity, consistency, and ultimately, confidence. In a world brimming with opportunities and uncertainty, it helps you stay grounded in facts, not fiction.

So, before your next investment move, ask yourself—have you done your homework? And are you equipped with the tools to do it well?